At timstuyts.com, we advocate adhering to a stringent trading plan as the primary means of navigating market psychology.

While market psychology, driven by supply and demand dynamics, dictates that prices influence purchasing behavior, investment psychology operates differently. In investment psychology, the allure of rising stocks prompts widespread interest, while declining stocks evoke aversion. This psychological response, marked by fear during market downturns and enthusiasm during upswings. In contrast when oranges are down, people feel good and buy.

Understanding this paradox requires embracing the Elliott Wave Principle, which acknowledges the herd mentality inherent in market behavior.

Mastering the urges of fear and greed is crucial for investors.

Introducing Broker: https://scandinavianmarkets.com/

Access deep liquidity and reliable trade execution by trading with a reputable Swedish STP forex broker.

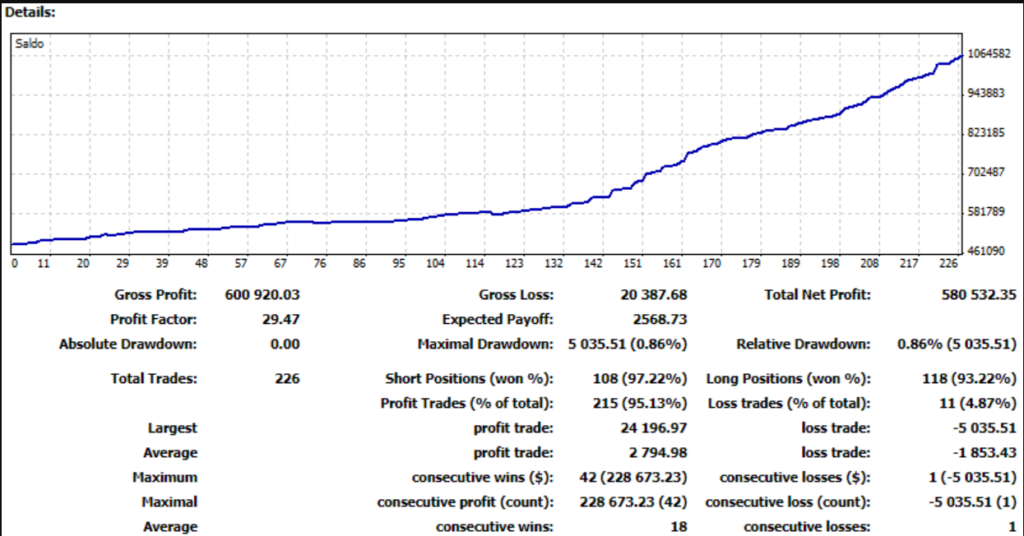

Track record